Enea’s Financial Puzzle: Putting the Pieces Back Together

IT services for communications

Enea is a Swedish IT company with a portfolio of products and solutions for telecom and enterprise networks. The offering is based on expertise in areas such as 5G, cybersecurity and cloud-based solutions. Typical services include handling subscriber data, managing mobile traffic and network security, Wi-Fi and IoT, coupled with embedded operating system solutions (OSS) and services.

The company offers these on a global basis, where Telecom clients comprise nearly 80% of sales, including notable brands such as Ericsson, Nokia, and Vodafone. Enea’s financial objectives are clearly defined, aiming to achieve a minimum EBITDA margin of 35%, complemented by consistent double-digit growth within its strategic focus areas.

Established 1965

Employees 476

Revenues R12 895 mSEK

Float 62%

Market Cap 2 150 mSEK

Instrument Enea

Ticker ENEA

Book Capitalization 2 188 mSEK

of which Debt 22%

Discover their solutions at

-> Solution Portfolio of Enea

Read further on

-> Financial Reports of Enea

| A Take from Fru Vasall |

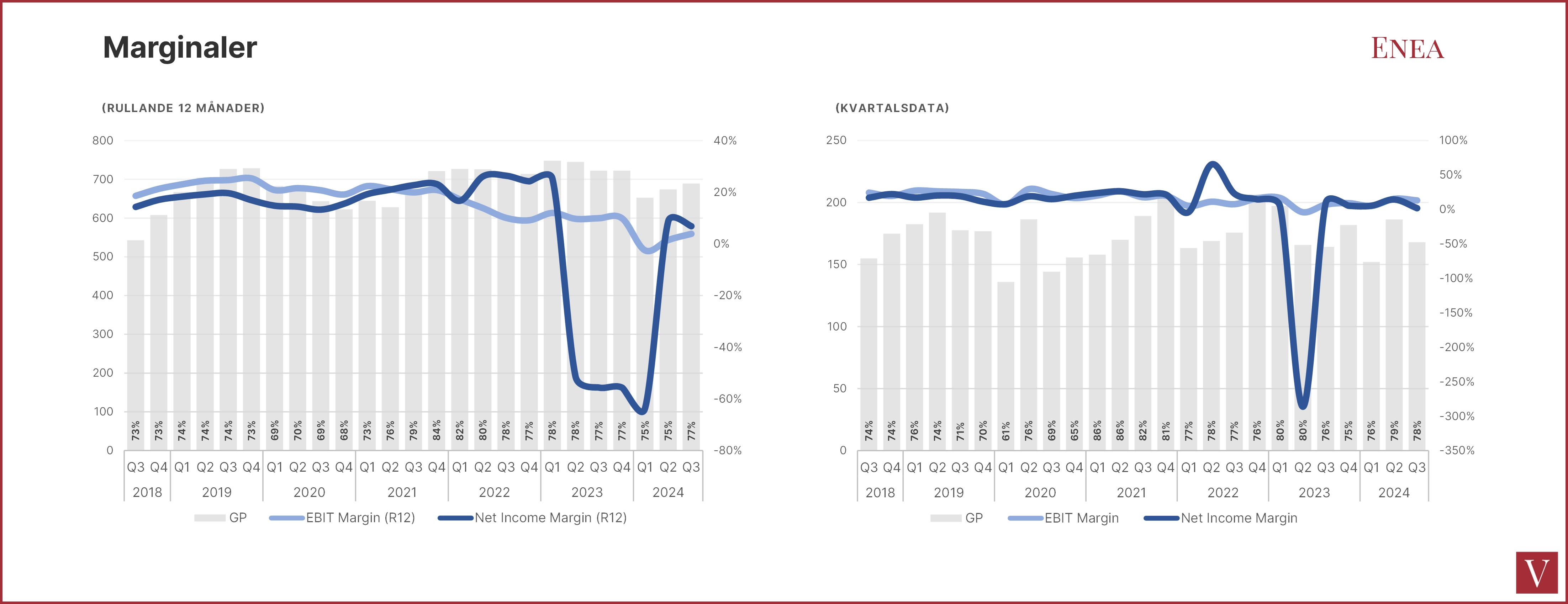

Recent history of volatile operations

Enea has experienced volatility in its operations over the past few years, with its traditionally stable adjusted EBIT margin averaging approximately 23% between 2012 and 2021, showing a notable decline to 14% in 2022. This downturn can be attributed to challenges within the legacy Operation Systems Solutions business and unsatisfactory progress in growth segments, which have been partly influenced by a weak market and suboptimal execution strategies.

Consequently, the company’s share price has suffered, dropping from its historical high of 280 SEK to 50 SEK. Additionally, the financial year 2023 has proven to be quite demanding for Enea, as a key telecom client abruptly terminated a significant project. This development has imposed a substantial impact on the company’s income statement.

Refocus actions taken, growth and margin expansion are underway

This recent disruption presented the company with a valuable opportunity to scrutinize its internal operations and contemplate the deteriorating macroeconomic prospects. Consequently, the board of directors made the decision of re-appointing Mr. Anders Lidbeck as the new CEO. Mr. Lidbeck previously boasts a successful track record of being Enea’s CEO from 2011 to 2019.

Subsequent to Mr. Lidbeck’s appointment, the company promptly announced an initial cost-reduction initiative, targeting annual savings of SEK 60 million. This program has already been set into motion with the implementation of additional measures. Under the strategic guidance of management, the company has also bolstered its sales performance by prioritizing high potential prospects. Given that cybersecurity contributes 40-50% to the Network Solutions segment’s revenue, Enea is well-poised to re-ignite growth, even amidst a low-capital expenditure climate within the telecommunications sector.

| A Take from Fru Vasall |

Growth through Acquisitions? The past and what’s next

Enea has executed approximately one acquisition per annum during 2016 to 2022. It is significant to highlight that the aggregate purchase price for these acquisitions amounts to around SEK 2 billion, a figure that aligns with the company’s current market capitalization. Despite of hefty multiples being paid, the acquisitions have yet to show substantial results.

On the upside, these strategic acquisitions have reinforced Enea’s product offerings, expanding its portfolio to ten distinct products and serving a diverse client base of over 100 clients. This diversification has effectively mitigated revenue concentration risk, as no single customer now represents more than 10% of the company’s total turnover.

During a turnaround period, it is customary for a company to prioritize internal operational efficiency and performance. However, with Enea starting to show signs of growth and margin recovery, it may be an opportune moment to consider external investment. The company got plenty of dry powder, with a net debt ratio of approximately 0.5 times its EBITDA and a healthy accumulated cash flow of over SEK 280 million, supplemented by unused credit. Looking ahead, it is conceivable that Enea will focus on securing target companies that provide complementary offerings and/or adding to its geographical presence within emerging markets to stimulate growth potential.

5G for Enea

Regarding 5G deployment, it is important to clarify that while Enea’s product offerings are not especially tied to the 5G market. Enea is set to engage in the latter stages of the ’core network’ construction. 5G has been substantially delayed compared to industry expectations, which has in turn deferred the return on Enea’s investments in this domain.

However, once the market conditions align and 5G adoption accelerates, it is anticipated that Enea will likely recover its former profit margins and growth trajectories.

Increased product confidence

Since the new CEO stepped in, Enea has undergone significant transformations in terms of strategic orientation and cost management.

The previously declining Operation Systems Solutions segment now constitutes merely 9% of the total sales. It is noteworthy that despite a still lukewarm market, the order momentum within the cybersecurity segment, which represents approximately 45% of sales, and the telecom segment, contributing around 50%, is showing signs of positive acceleration.

Additionally, Full-Time employees has decreased by approximately 20% since the second quarter of 2022. These traits collectively indicate the culmination of the turnaround process, thereby increase confidence in Enea’s market position and future ready product portfolio.

The recent positive order momentum has been further reinforced by the renewed 5G NDL order (announced last week) with a Tier 1 US operator (likely T-Mobile), with a committed value of USD 18m (plus a USD 3m option).

Together with two other recent order announcements (totalling USD 5m) and the strong momentum in its cybersecurity offering (+12% YoY in H1), this will support organic growth ahead. I expect organic growth of +4% YoY in H2 vs. -5% YoY in H1 (albeit partly due to tough comps in Q1).

| A Take from Fru Vasall |

Financial Goals

- EBITDA margin of 35%

- Double-digit growth in focused areas like Network and Security segment

The EBITDA margin has averaged 32% over the past five years. For 2024 Q3, EBITDA margin reached 33%, while 2023 full year, EBITDA margin was 34%, which shows that our long-term target of an EBITDA margin of over 35 percent on a full-year basis is well within reach.

Growth amounts to 9% for Network and 12% for Security 2024 Q1-Q3 (vs same period 2023) combined with a shrinking segment of Operations System. Considering the years of turbulence Enea went through, without clearer and further information, even if order intake momentum is regained, we can only rely on recurring revenue to estimate future growth.

That is to say, the potential of reach double-digit growth in main segments is unsure until more stable growth quarters appear.

Notable Risks

Enea is a modestly sized player in the market, which may potentially face heightened competitive pressures. Moreover, the advent of disruptive technologies could pose challenges, as evidenced by its embedded Operation System Solutions offering.

Should Enea persist in its M&A strategy, there are inherent risks associated with the integration process and the identification of appropriate acquisition targets.

Additionally, there are concerns regarding the potential implications of diversifying beyond the company’s established core business.

Conslusions

Enea has a business with likely scalability and good earnings capacity compared to the situation today.

Considering its shaky past, the company is clearly traded at a discount. I wonder if another bad news day may present a risk of a repeat writedown similar to what happened in 2023. If so, that mountain of nearly SEK 2 billion in Intangible Assets can have an outsized effect on the financials.

However, now that Enea seems to sort things out, and enjoy a positive news cycle, then I assume an upwards revaluation will take place. A bit of growth and its effect on operational gearing will boost margins, which in turn may push multiples upwards at the same time.

Looking to downside protection a share buyback programme has been in place for a year, and will continue up to SEK 100 million.

Will Fru Vasall open her wallet today?

Yes, I will take a position in Enea. Short term I look at the price moving towards the SEK 125 range.

Buying Enea