Engineering for the Long Haul: Rejlers Resilient Approach

Rejlers is a Nordic technical and engineering consulting company providing services in areas of energy, building, infrastructure, telecommunication etc. across Sweden, Finland, Norway, and the UAE. The company specializes in areas such as project management and project engineering, as well as systems for heating, ventilation, air conditioning, piping, plumbing, and automation.

Discover their solutions at

-> Solution Portfolio of Rejlers

Read further on

-> Financial Reports of Rejlers

Established 1942

Employees 3 286

Revenues R12 4 340 mSEK

Float 81%

Market Cap 3 290 mSEK

Instrument Rejlers

Ticker REJL B

Book Capitalization 2 577 mSEK

of which Debt 28%

| A Take from Fru Vasall |

Good Track record guided by quality management

The company experienced a prolonged phase of instability until the appointment of the current CEO, Viktor Svensson, in 2018. Since then, Viktor has taken his deep experience gained from industry leader in addition to rival AFRY and transformed it into a solid increase of sales and margins.

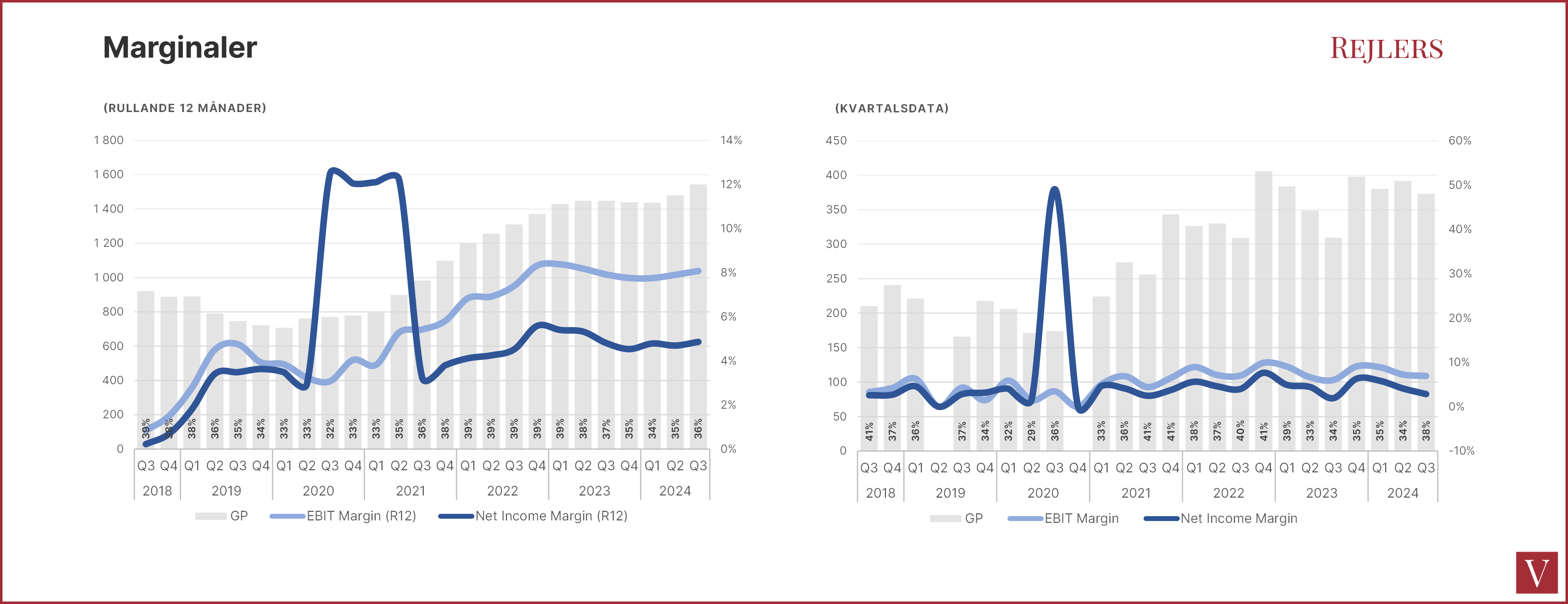

After the new strategy was put in place in 2018, EBIT margin has increased from below 2 percent to recently around 8 percent, measured on a rolling twelve-month basis. The absolute margin has improved at 34 percent CAGR over 2018-23, now settled just slightly behind other comparable consultancy firms such as AFRY and Sweco.

Growing organically and through acquisitions

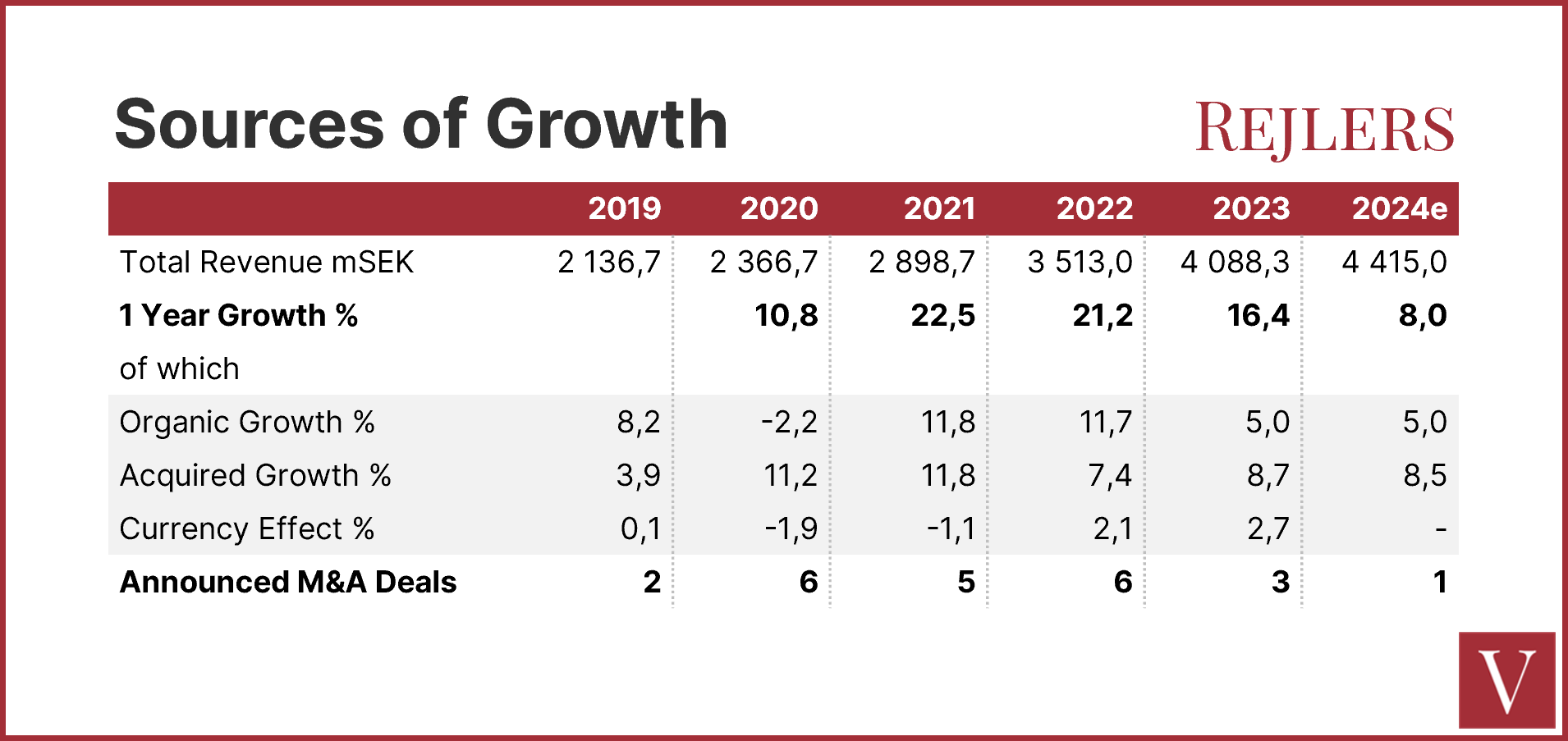

Rejler’s strategic financial objective includes achieving a 10% average annual growth rate (from 2018 to 2025). From the table below, we can see it is sailing well along its predetermined course. Notably, organic growth has decelerated to 5%, which is consistent with industry norms, particularly given the dampened outcome of its core operations in the construction and community sectors amidst an economic downturn.

Originally exposed to energy trends, Rejlers’ financial report indicates an elevated focus on the energy transition segment, aiming to capitalize on energy and infrastructure initiatives. This strategic focus is anticipated to either maintain or potentially stimulate greater organic growth.

Growing organically and through acquisitions

As for acquisitions, Rejlers has executed a host of M&A activities in the past, notably slowed down in the last two years. The company says it is still actively searching for potential targets.

However, I assume with the heightened cost of money and end-markets in disarray that finding, financing and motivating good deals is a cumbersome challenge.

With its current total debt/EBITDA ratio standing at 1.15, it is highly conceivable that Rejlers maintains the financial capacity to undertake further acquisitions.

Staff Count and Utilisation Rate

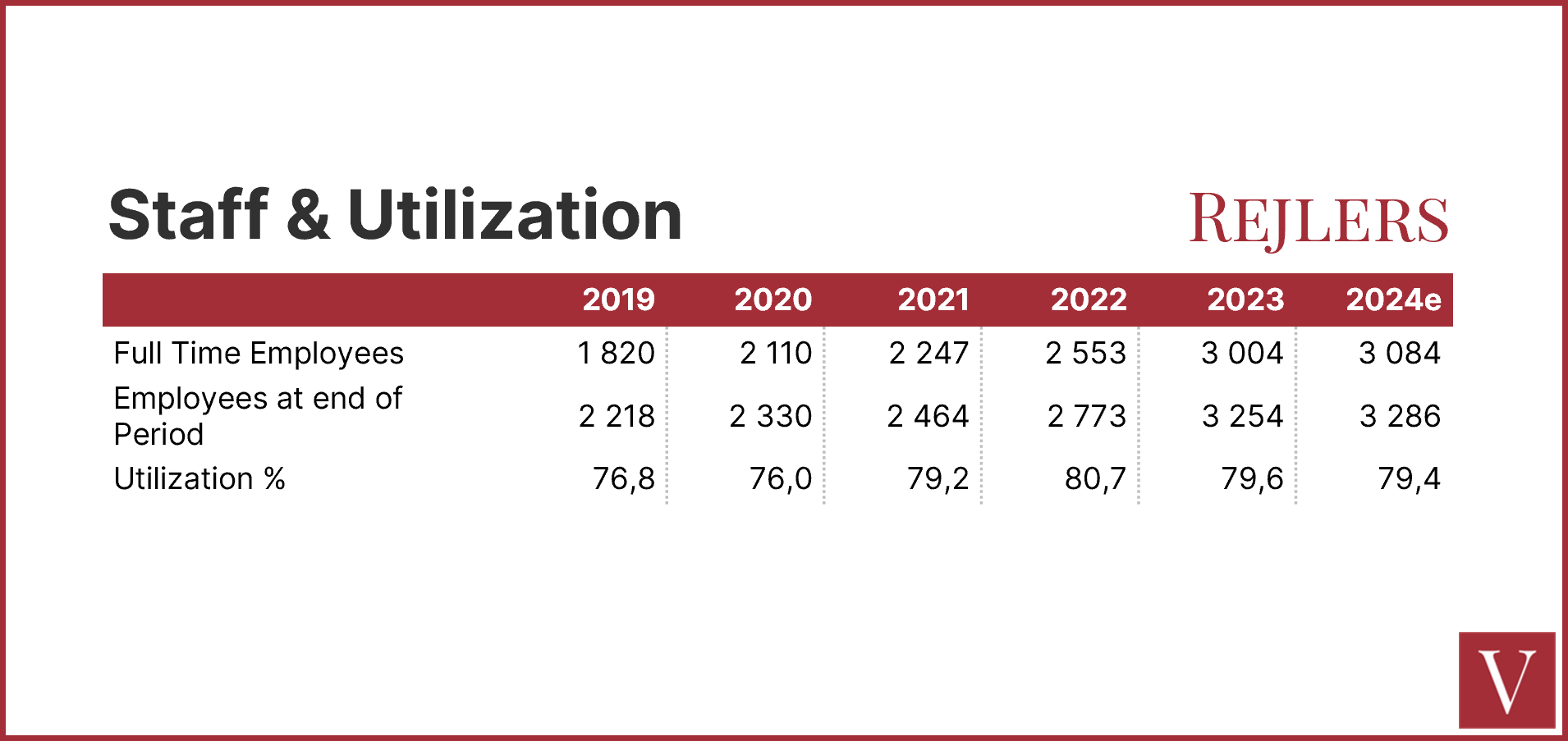

In evaluating the overall development of the company’s businesses, it is essential to consider the implications for the required staffing levels for both current and anticipated projects.

The company has been hiring 8-10 percent more employees annually. Including the year of 2023 when Rejlers launched an efficiency programme which involved the reduction of 75 staff members in response to the deteriorating performance of its building division.

Despite this restructuring, Rejlers swiftly pivoted its focus towards the more robust energy sector and maintained its recruitment efforts. The utilization rate has consistently remained stable within the range of 79-80%.

| A Take from Fru Vasall |

10% EBITA Margin?

Rejlers has its financial target set to achieve a 10% annual growth and EBITA margin. The company is on track for growth. As for EBITA margin, currently stands at circa 8% from a group level perspective.

Looking into its divisions, Sweden has in this year amounted to 8.5% by Q3; margin targets achieved in Finland; and Norway which contributes only 7% of sales disappointed the public with a 3.3% (7.3%). Replacing management is underway in Norway in the effort of achieving financial targets.

In the past years, Q4 is seasonally strong. So, it is not impossible that Rejlers can close or come very near to its EBITA target. I also do not rule out a higher 2030 EBITA margin goal. The company states that the new targets will be presented no later than in connection with the AGM in the spring.

Pricing Power

Considering Rejlers is not as strong a brand as its competitors, there is a potential concern of smaller offering and limited pricing power. The recent reports, however, have shown its ability to increase prices in all countries. As a matter of fact, the improvement of price level, is a huge addition to earnings of most units.

The company has shown that its incremental positive changes in pricing can retain client accounts, and thus have material positive impacts free of trade-offs.

Notable Risks?

The group has three overall focus areas, which are energy transition, industrial transformation and futureproofing of communities.

The economy is a bit tougher with a bigger slump in the construction and property sector. At the same time, Rejlers seems well positioned towards the energy sector, which is a heavy focus area.

The chance of lower order intake can negatively affect utilisation. Also, 3000 employees’ salary increase may outpace price hikes.

As regarding to the rumour of CEO Viktor Svensson being a highly relevant CEO candidate for going back to lead AFRY, it has been a year, and no such follow up news or announcements have popped up to date.

So far, all seems under control.

Conslusions

Under capable management which has performed a strong turnaround since 2018, guided by clear and ambitious goals, I view the continued development robust and sustainable. Rejlers is currently valued at a discount EV/EBITA, of at least 20%, comparing to technical consulting peers. If the company maintains its current LTM performance over the long term, I approximate we may see an almost doubling share price potential.

In the short to mid term the company value would still be constrained by its current valuation, and I set a target for pricing in the 185 SEK range, with a possibility that momentum may drive it closer to 200 SEK per share.

Will Fru Vasall open her wallet today?

All in all, I think Rejlers is a share worth buying, and I will be monitoring it for an opportune time to step into a position.

Buying Rejlers