Bravida’s SEK 98 Price Target: Attractive Valuation but Lacks Immediate Catalyst

Scandinavian’s Top Supplier of Technical Installation & Services

Bravida offers technical installation and services to buildings and industrial facilities in Sweden, Norway, Denmark, and Finland. The expertise encompasses three core technical domains, ie electricity, plumbing, and heating, ventilation, and air conditioning (HVAC). The company’s revenue distribution is equitably balanced between service provision and installation activities.

Founded 1922

Staff Count 13 800

Revenues R12 29 651 mSEK

Float 98.5%

Market Cap 16 300 mSEK

Instrument Bravida

Ticker BRAV

Capitalization 11 977 mSEK

of which Debt 31.6%

Explore their solutions

-> Bravida Portfolio

Explore their financials

-> Bravida Financial Reports

| A TAKE FROM FRU VASALL |

Investment Rationale

- Good cash generation performance

- Bravida is the market leader in Sweden, Norway, Denmark, and no.4 in Finland, taking an active role in consolidating the still-fragmented Nordic technical installation service market. This strategic standing, coupled with its sound financial position, equips the company with ample liquidity to pursue and capitalize on potential growth opportunities within the ongoing consolidation of the underlying market.

- Stability in business operations: according to the company, Bravida has over 80,000 customers, of which 98% are recurring ones, and no customer accounts for more than 4% of total sales.

- The stock trades at a 2025E EV/EBITA of 9.5 versus average of 13x since 2015. Given a potential recovery in the installation market in 2025 H2, this presents an opportune moment for investors to consider initiating a position.

- Dividend yield 2024E to around 4.5%.

Soft Market

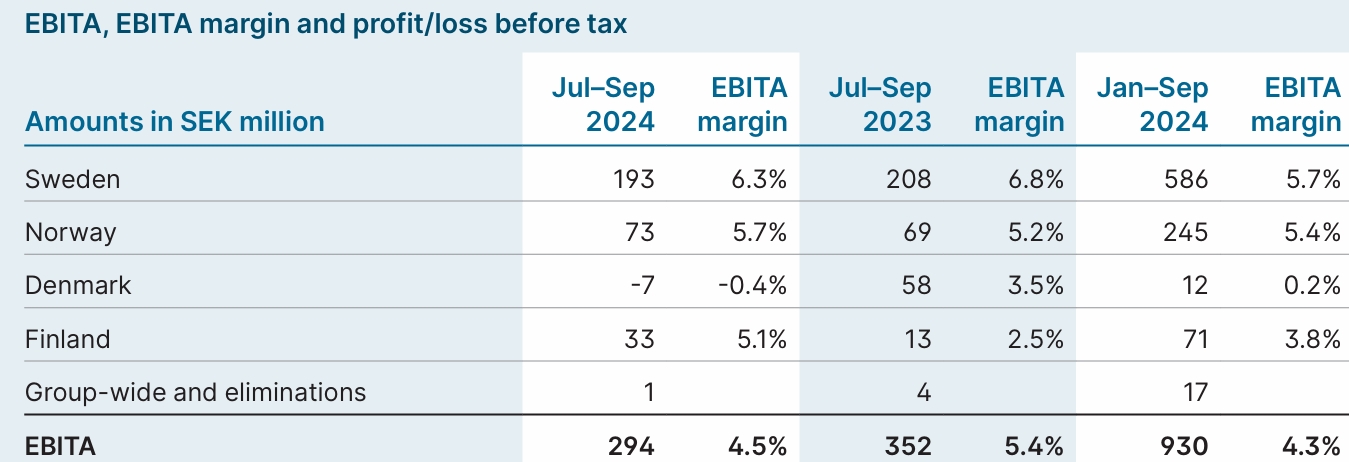

Bravida has experienced a stagnation in growth, primarily attributed to subdued market conditions, particularly in the regions of Finland and South Sweden. On an organic basis, all areas underwent contraction with the exception of Finland, which remained stable. Delving into the company’s revenue composition, installation activities reported a decline of 7% YoY, contrasted with an 8% increase in service provision. The company’s EBITA amounted to SEK 293 million, reflecting a decrease of 17% from the previous year and resulting in a margin of 4.5%, a contraction of 89 basis points YoY.

The financial statement incorporated SEK 19 million categorized as ”non-recurring items,” which encompassed branch closures and other write-downs. We would highlight these elements, as they are directly connected to the ongoing process of branch consolidation and workforce optimization, which we consider to be integral to the standard course of business operations. In the context of the restructuring initiatives undertaken in Sweden, the closure of five branches in South Sweden has impacted revenues by approximately SEK 250 million year-to-date, equating to an annualized figure of around SEK 330 million.

Service offset some of the installation market drop

According to the company, the two segments, installation and service are defined as, Installation, which involves new construction and refurbishment of technical systems in buildings, facilities and infrastructure; while service consists of operation and maintenance assignments, as well as minor upgrades of technical installations. Under the current market conditions, while the installation part continues to exhibit a softened state, the service segment would by nature be on the spotlight. We anticipate that service revenues will demonstrate resilience, 8% YoY increase in Q3 for example.

The installation market is undeniably influenced by the construction sector, which recent statistics from Sweden, Denmark, and Finland reveal to be experiencing a general decline. Despite these subdued levels, there is potential for an upturn in construction activity as a result of decreased financing costs. Nevertheless, based on company guidance and the analysis presented during the earnings call, data provided by external stakeholders suggests that the positive impact of these cost reductions may not be fully reflected in the financial metrics until the later H1, or H2 2025, due to the extended timelines of such projects.

The first positive margin delta in 2024 Q4 after 3 years?

We understand that Bravida is making new operational decisions, exemplified by their selective approach to project acquisitions during Q3, which is reflected in the 16% decrease in organic order intake growth for the period. Concurrently, the company has implemented cost-reduction measures, including a workforce reduction of approximately 300 full-time and the consolidation of 20 cost units. These actions are indicative of a focused effort to mitigate the potential for a recurrence of past challenges. Looking ahead, with the anticipated completion of major projects in Denmark and the tangible outcomes of operational enhancements in Norway and Finland, we project that the fourth quarter will mark the first instance in 12 quarters where Bravida achieves a positive YoY EBITA delta.

Financial Goals

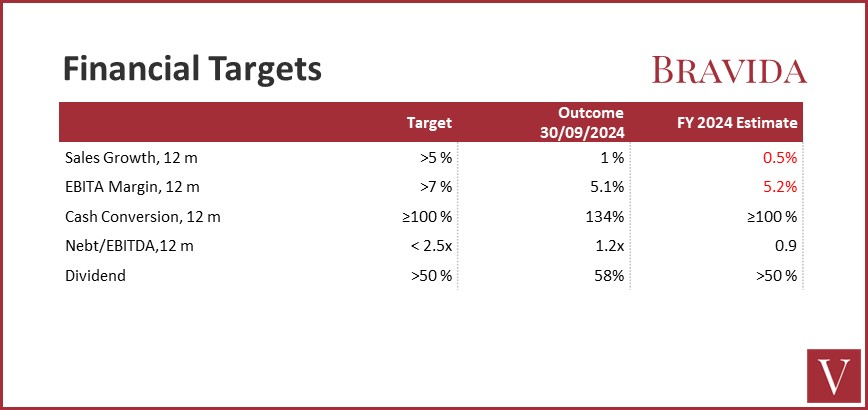

- Profitability – EBITA margin of >7% including the dilutive effect of acquisitions.

- Sales Growth – increase sales by >5% p.a.

- Cash efficiency-cash conversion ratio (OpCF to EBITDA) of ≥100%.

- Capital structure- to enable a high degree of financial flexibility and provide scope for acquisitions. The target is a ratio of net debt/EBITDA < 2.5x.

- Dividend – to pay out at least 50 percent of the Group’s consolidated net profit, taking account of other factors such as financial position, cash flow and growth opportunities.

The financial targets of Bravida encompass five key areas, which have been outlined above. Upon examining the data presented in the table, it becomes evident that most of these targets are eminently attainable, given the company’s performance trajectory. However, it should be noted that sales growth and the EBITA margin may pose challenges, as they appear to be in line with prevailing market conditions. These two indicators are anticipated to be particularly tough to achieve within the coming two to three-quarter period.

| A TAKE FROM FRU VASALL |

Notable Risks

- As the construction and property sectors are sensitive to change of interest rates and market volatility, if rises in interest rates and prevail of inflations take place, it would impede the fundamental market demand for new construction projects and renovation works, thereby potentially adversely affecting the demand for installation services

- Early 2024, there was an invoice mark-up scandal in Bravida, which caused 10% stock drop day 1 of the news. If similar event occurs once more in public, it may cost market confidence sharply again.

- Operating with high labour intensity, there are inherently limited avenues for margin enhancement. Particularly in cases where prospective salary augmentations cannot be reflected in increased contractual values

- Fail to achieve and sustain profitability in line with financial targets. Two out of five financial target of Bravida may be slight difficult to achieve in these two years, i.e. sales growth over 5% and EBITA margin over 7%

- The current backlog of installation projects secured at predetermined prices may potentially exert downward pressure on margin performance

Conclusion

Q3 report marked the 12th consecutive quarter of negative YoY EBITA delta, accompanied by a 3% shortfall in EBITA comparing with consensus. Nevertheless, the company’s cash flow performance remained robust. Having observed from a neutral standpoint for an extended period, we think that the most challenging operational period may have concluded, as evidenced by the recent resolution of certain problematic ventures in Denmark. This enhances our anticipation that Q4 2024 may be the first positive YoY margin delta since 2021 Q3.

SEK 98 Target Price Presents good entry, yet lacks trigger

The valuation presents an appealing proposition, with 2025 estimated EV/EBITDA ratios of 9.5x, suggesting a compelling entry point for investors. It is important to note that our current evaluations do not incorporate any potential M&A activity. Given the company’s substantial financial capacity, as indicated by a projected 2026E net debt/EBITDA ratio of 0.2x, there is ample room for strategic acquisitions that could bring more upsides. As of end of Q3 2024, Bravida has completed a total of nine acquisitions, six of which are situated in Sweden and three in Finland, contributing approximately SEK 464 million to the overall sales.

However, Bravida’s market outlook indicates that the prevailing tough conditions are expected to persist until earliest mid-2025, implying that the pricing scenario in the significant markets will not see immediate relief. Along with multiple practical risks and concerns, in light of these considerations, we maintain a ”Hold” recommendation, with a price target of SEK 98.

Fru Vasall is Neutral pending the market recovery conditions for Bravida

Hej kära läsare! Stort tack för att du har tagit dig tid att dyka ner i våra tankar!

Jag vill gärna bjuda in dig till en dialog! Vad tyckte du var bra? Vad kan bli bättre? Har du en helt annan åsikt om något ovan?

Ser fram emot att höra från dig. Med värme // Vasallen