Electrolux’s Bumpy Path: Challenges Loom as Recovery Begins

Leading Household Goods Provider

Electrolux is a global leader in the production and distribution of household and professional appliances. The diverse product portfolio encompasses a wide range of appliances, like refrigerators, ovens, cookers, dishwashers, washing machines, vacuum cleaners, and air conditioners, along with an assortment of smaller domestic products. Brands include Electrolux, AEG, Zanussi, Frigidaire, and Electrolux Grand Cuisine, and the Group sells more than 60 million products to customers in more than 150 markets annually.

Given that the sentiment stays low and the stock trading is close to its historical all-time low EV/sales multiples, we decided to take a closer look at Electrolux to review its potential for bottoming out.

Founded 1901

Staff Count 45 000

Revenues R12 133 818 mSEK

Float 79%

Market Cap 23 000 mSEK

Instrument Electrolux B

Ticker ELUX B

Capitalization 54 300 mSEK

of which Debt 83%

Explore their solutions

-> Electrolux Portfoilo

Explore their financials

-> Electrolux Financial Reports

| A TAKE FROM FRU VASALL |

Investment Rationale

- Facilitated by the interest rate hikes and subdued consumer sentiment, demand continues to exhibit signs of weakness. However, the emergence of interest rate reductions suggests a potential recovery on the horizon. This dynamic of consumers opting for more economical choices has a pronounced effect on Electrolux, given the company’s established presence in the mid to high-end market segments.

- Particularly within the North American market, escalating cost inflation and operational hurdles have significantly impacted growth and profitability in the past two years. Nevertheless, the implementation of cost reduction initiatives and enhancements in operational efficiency within this region are anticipated to contribute positively to margin expansion in 2024-2025.

- Electrolux is susceptible to the dynamics of the new residential construction sector, which, coupled with replacement, renovation, and remodeling activities, are central to the overall demand for appliances. Given the anticipation of decreased interest rates in 2025, the residential market is poised for a positive trajectory, which in turn is likely to favour the appliance industry. Nevertheless, bear in mind that a reduction in interest rates may enhance consumer spending and boost the abovementioned residential activities in mature markets, but such influence is expected to manifest with a delay in demand.

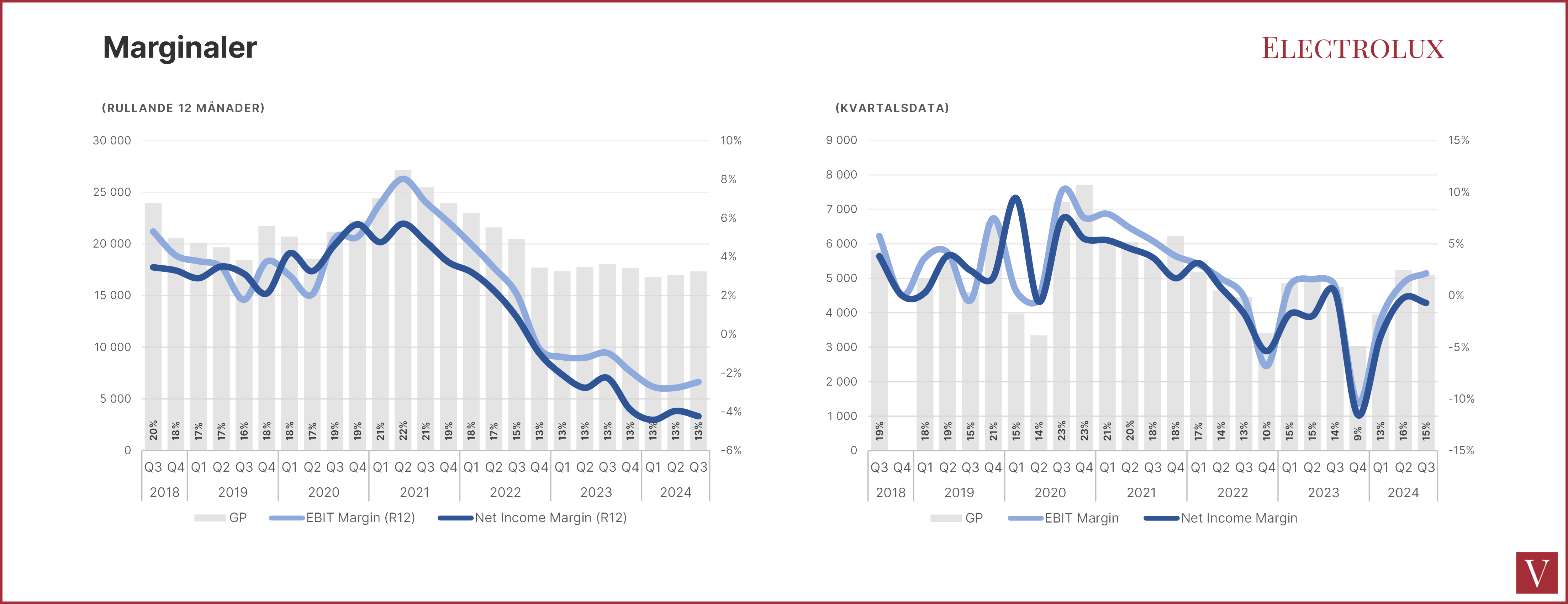

- 2024 has realised 2 consecutive quarters of positive operating margin, although of barely 1 %, worth looking into its internal and external, to see if it is the cost programmes and restructures settle for long-term effect.

New CEO in place from Jan 2025

Electrolux has announced the appointment of Yannick Fierling as the new President and CEO, succeeding Jonas Samuelson. Mr. Fierling’s tenure commenced in October, to ensure a seamless leadership transition. Although the official announcement of his appointment was made in August, the effective start date for CEO and president is January 1, 2025. Mr. Fierling, Frech, having served as the CEO of Haier Europe from 2015 to 2024, as well as Whirlpool from 2000 to 2015. His appointment is anticipated to invigorate Electrolux with fresh perspectives and constructive strategies, following a period where the company’s image has been perceived by some as distinguished yet somewhat static.

Cost Reduction Initiatives

YTD cost savings amounted to SEK2 billion, with SEK1.2 billion shown in the Q3 report, and the 2024 guidance remained unaltered at SEK4 billion, indicating SEK2 billion to be realized in Q4. It has also highlighted the intention to sustain these cost-cutting efforts beyond 2025 and continue identifying additional prospects for further cost reductions.

The company has been enforcing cost reduction initiatives, including staff downsizing, value optimization, and procurement from economically advantageous regions. All of these initiatives may take time to fully substantiate into P&L. According to the Electrolux conference call, the cost reduction strategies are proceeding on target, despite challenges from logistics. Workforce optimization is coming to an end. The company is now transitioning its focus toward product cost initiatives, with a notable emphasis on leveraging the cost advantages associated with low-cost country sourcing, particularly in Asia. Management aims to amplify sourcing activities in Asia from 20% to more. The establishment of a definitive percentage increase for Asian sourcing remains open-ended and contingent upon various factors, such as geopolitical tensions and tariffs. Electrolux maintains a prudent stance due to the inherent unpredictability of the outcomes and their possible effects on trade policies.

North America turnaround

Although walking in the right direction of earnings recovery, the progression was at a more tempered pace than anticipated, largely due to sustained losses in the North American market. In contrast, Europe and the APMEA (Asia Pacific, Middle East, and Africa) regions present enhanced performance, and Latin America is positive which is in line with estimates.

Compared with other geographic regions, the North American arm of Electrolux had a glorious past of strong pricing with robust growth, until 2022. Then a series of challenges appeared over the last two years, marked by persistent manufacturing efficiency concerns, escalating labour costs, and pronounced supply chain disruptions.

Now after in the red for ten consecutive quarters, price tension persists as the primary concern in the North American market. Even when sequential pricing declines have ceased, regional gross margins in North America are currently insufficient to cover operational overheads. The good thing, there is an additional SEK 2 billion in cost reductions planned for the fourth quarter, with most of these cuts anticipated to manifest in North America. Nonetheless, given the prevailing market conditions characterized by low-cost imports from China, particularly in the refrigeration segment, we believe that these cost-saving measures are unlikely to propel the North American division to substantial profitability in Q4 or the foreseeable future.

U.S. steel prices are approximately 40% higher than those of their Chinese counterparts, which translates to a substantial cost advantage for companies like Electrolux when importing components and finished products from China, even with the existing 25% tariffs in place. For the refrigeration business, which constitutes half of North America’s revenue, this dynamic is particularly pronounced. In the long run, the company intends to enhance its competitiveness by increasing component imports from China, thereby narrowing the cost gap with rivals such as Haier, Midea, and Hisense. However, this strategic shift is expected to unfold over a more extended period.

The outcome of the recent U.S. election may have a more immediate impact if the proposed tariffs were effectively structured. Electrolux maintains two major manufacturing facilities within the U.S., supplemented by two additional plants in Mexico that serve the U.S. market. Presently, the company imports about 20% of its U.S. product sourcing from China. If new tariffs are also imposed on Mexico, this could potentially have adverse implications for Electrolux, as it may increase the cost burden on the company’s operations.

Springfield ramp-up

Electrolux reported that its US warehouse experienced an unscheduled closure, presumably a hurricane, for approximately one week, which adversely affected its operations. However, the company anticipates compensating for this disruption during Q4. Electrolux indicated that the Springfield facility is gaining momentum, with October production now meeting market demand for the first time. Nevertheless, there remains an ongoing focus on enhancing productivity, as the current workforce allocation per product exceeds optimal levels.

Electrolux has experienced a substantial decline in its North American market share since 2013, falling from a high of 23% to approximately 10% at present. However, we can see a glimmer of lights indicating recovery towards the Springfield factory’s ramp-up process. Springfield is one of the five in North America and holds significant importance due to the positive market reception of its products, i.e. kitchen/cooking products. The factory is likely providing some margin uplift given its higher level of modularisation and output lift, a 20% productivity increase for around one quarter of total North American units.

Moreover, considering that Springfield is dedicated to the manufacture of the most profitable category, cooking products, (except a few outsourced like microwaves) the ramp-up is essential for lifting margins in the region. The elevated productivity levels in Springfield can potentially contribute to operational efficiency and boost market share in North America.

Deleveraging path

Electrolux has adjusted its previously stated divestment target of SEK10 billion for non-core assets by excluding the Zanussi brand from the scope. The company may opt to pursue licensing opportunities for the brand rather than outright divestment, citing the current geopolitical and macroeconomic climate as not favourable. As of now, the total divestment amount achieved stands at SEK 2.3 billion, inclusive of the anticipated sale of the South African water heater business operating under the Kwikot brand, which is planned for completion in Q4. This progress has been somewhat hindered by the challenging market conditions that have affected valuations. The downsizing of a so-far sluggish divestment plan implicates a precarious direction for deleveraging. Another equity issuance may not be necessary, but investor’s concerns in this aspect are still valid.

Maintaining a high Net debt/EBITDA ratio, we do not see a risk an equity issuance. Moreover, it is anticipated to receive a cash influx of SEK 1.4 billion in Q4 from a divestment. Looking ahead, as cost efficiency and sales growth pick up pace over the next two years, we expect the Net Debt/EBITDA ratio to gradually decrease and approach a more conventional level of 2x.

| A TAKE FROM FRU VASALL |

Notable Risks

- Delayed realization of cost-cutting may be detrimental to positive estimations

- If Electrolux delays or fails to implement its divestment plans, it may further deteriorate market sentiment.

- Prolonged periods of promotional activity could keep margins low

The ongoing process of migrating production lines in the United States can be complex. - As a global company, in some regions, Electrolux is subject to significant currency fluctuations, Brazil for example

- Imposition of new import tariffs in the US presents a scenario with the potential for dual implications

- The appliances sector is inherently competitive. If Chinese or Korean competitors initiate any aggressive market share movement, this could potentially destabilize industry pricing dynamics

- Last but not least, should Electrolux’s operational performance not exhibit the anticipated improvements, it may necessitate a capital injection to strengthen its balance sheet.

A special mention on Intensified and extended promotional events

Promotions have been intensified, primarily because the overall demand is mainly driven by replacement needs in both European and North American regions. Furthermore, the persistent cost differentials between Asia and Europe/North America have facilitated Asian competitors to adopt increasingly promotional strategies. Correspondingly, Electrolux is forced to create, attend, and extend more promotional events. For instance, the Black Friday sale period has progressively expanded to encompass almost the entire month of December over the past few years, plus regional traditional and sales festivals. But there are also all types of other events. Leaving the public to wonder, what exactly the product/brand position is, if it is almost always discounted.

Q4 foresees small improvement

Electrolux is aiming to realize SEK 2 billion in cost savings in Q4. Notwithstanding, the company operates within a challenging market landscape characterized by subdued demand and intense competitive pressure, marked by a high frequency of promotional activities. These market pains are not foreseen to be alleviated in the near future. Our forecast for Q4 includes a 6% increase in organic growth and an adjusted EBIT of SEK 1.2 billion, reflecting a sequential improvement of SEK 0.5 billion.

Electrolux at a Glance (2024 Q3)

- Q3 Group sales amounted to SEK33.3bn, in line with consensus

- The Latin American market experienced robust growth at 26%, while Europe surpassed expectations with an organic sales increase of 3%.

- Meanwhile, North American sales were marginally below projections, as anticipated

- Group operating margin at 2.2% missed expectations by 70bps, resulting in a 25% profit miss

- Europe delivered a positive performance surprise supported by a positive mix, volume growth, cost savings, and raw material benefits. However, this was more than offset by disappointments in North America and Latin America

- The company’s cost efficiency initiatives yielded a SEK1.0 billion positive effect. Conversely, external factors had an unexpected negative impact of SEK-0.2 billion, primarily attributed to currency fluctuations, which was a notable shift from the positive SEK0.4 billion seen in Q2

- Concerning liquidity, the operating cash flow post-investments remained strong at SEK1.1 billion, consistent with the level reported in the third quarter of the preceding year.

Cautious Optimism for Electrolux: Sales Beat, but Profitability Remains Elusive

Although Electrolux has marginally surpassed consensus sales estimate in Q3, the wishy-washy execution of cost reduction initiatives and divestment plan have cast a shadow over the company’s ability to realise profit growth. The outlook remains weak to neutral.

Our analysis indicates that the market may be overly optimistic regarding the company’s sales and earnings recovery, plus the prevailing competitive landscape coupled with political and economic conditions, let alone the structural challenges faced. Despite the anticipation of a recovery in the residential sector rising from interest rate cuts, we are inclined to maintain a cautious stance for Electrolux, as it might require longer to achieve real improvements in profitability and cash flows, as well as letting the company come down to a more healthy leverage level.

SEK 82 Target Price Reflects Challenges, CEO Transition, and Economic Risks

Consequently, we have our outlook for the company’s 12-month target, set at a price of SEK 82, which is predicated on a 7.5x EV/adj. EBITDA.

We foresee a small result improvement in Q4, however current sentiment is crushingly low. We think it will take time for Electrolux to recover profitability and cash flow, which is why we recommend holding off.

For interested investors, we do recommend a close follow-up on this company, since all strategic options remain on the table, as the new CEO joins, and the impact of the Trump administration, potential rising tariffs on products from China, which in turn hurts margins.

Even falling steel prices can have great impact on cost reduction (i.e. steel accounts for 50% of component costs).

Fru Vasall is Neutral pending signs of turnaround for Electrolux

Hej kära läsare! Stort tack för att du har tagit dig tid att dyka ner i våra tankar!

Jag vill gärna bjuda in dig till en dialog! Vad tyckte du var bra? Vad kan bli bättre? Har du en helt annan åsikt om något ovan?

Ser fram emot att höra från dig. Med värme // Vasallen